Hi there,

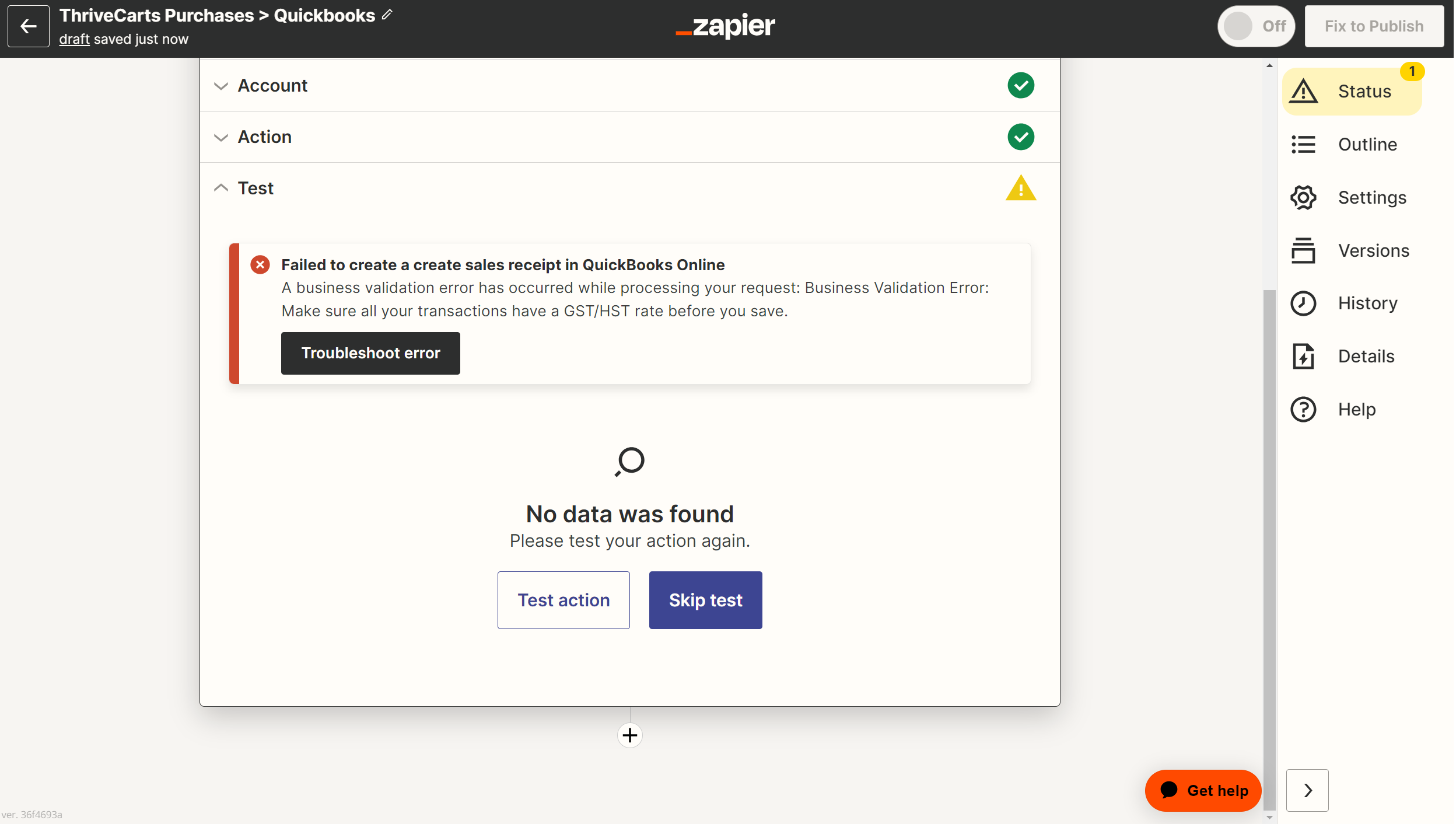

I'm having trouble setting up my Zap that will hopefully connect Thrive Carts to Quickbooks. The error message I'm receiving reads: Business Validation Error: Make sure all your transactions have a GST/HST rate before you save.

I have set all of the Tax settings that I can - does anybody happen to have any information on how best to connect these two platforms? I'm guessing that I'm not the first person who's attempting to connect Thrive Carts and Quickbooks.

Any insight would be appreciated. Thank you.