Hi There,

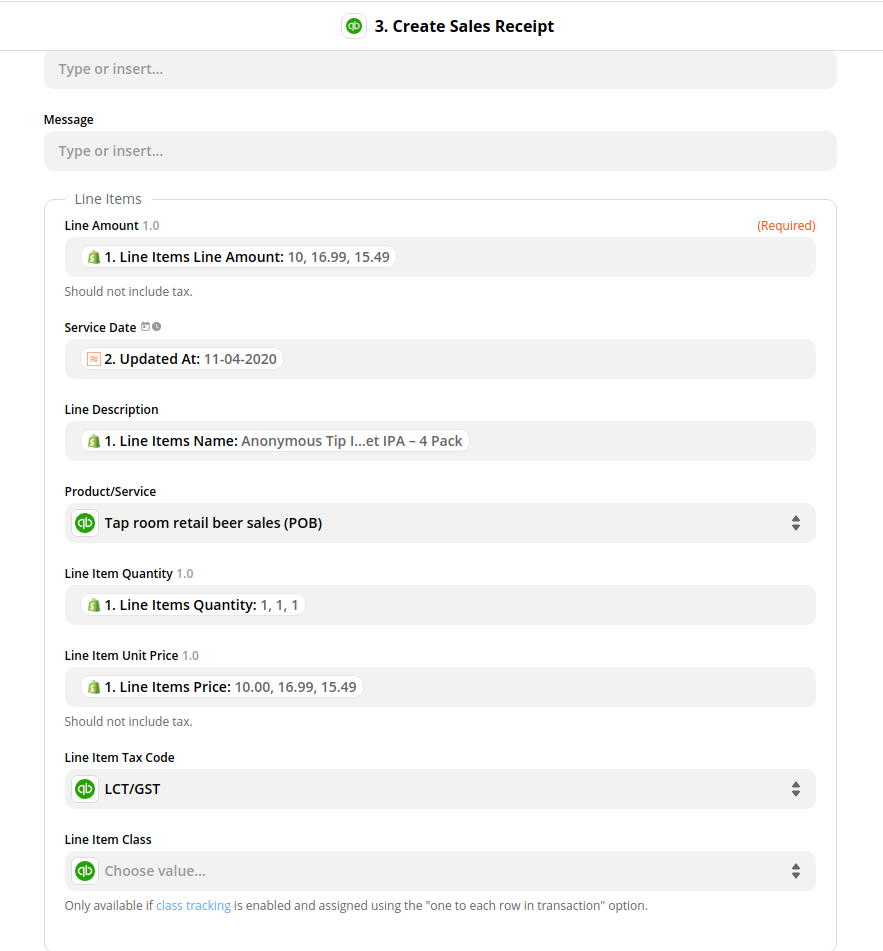

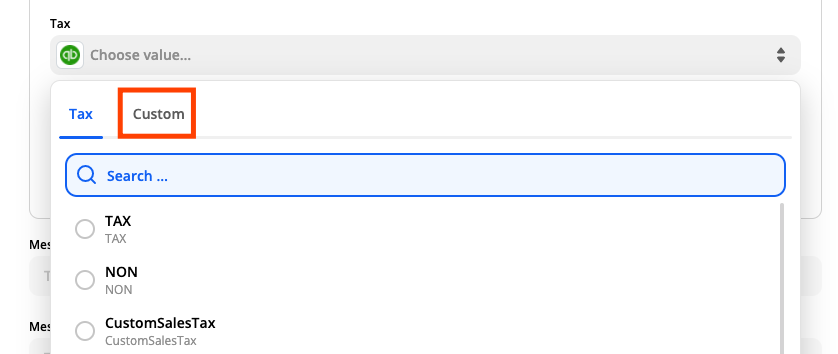

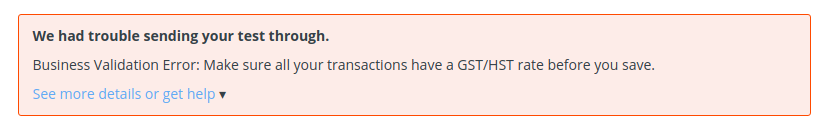

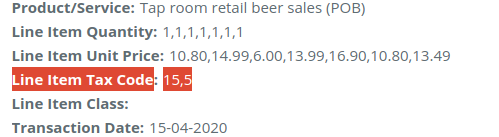

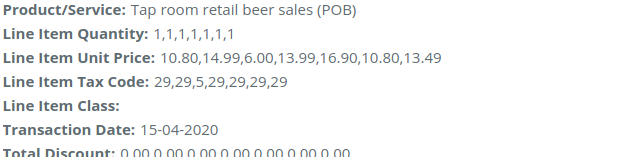

I have a working new shopify order to quickbooks online sales receipt zap. I have recently added items to my store that have made me now have different tax codes. I see that the zapier integration passes

TaxCodeRef

value

for each line item but when creating the zap I dont see a mechanism to put any logic into the line items to change their tax codes depending on what the product is.

Also open to better suggestions on how to do this. Thanks!

Brent