Hi!

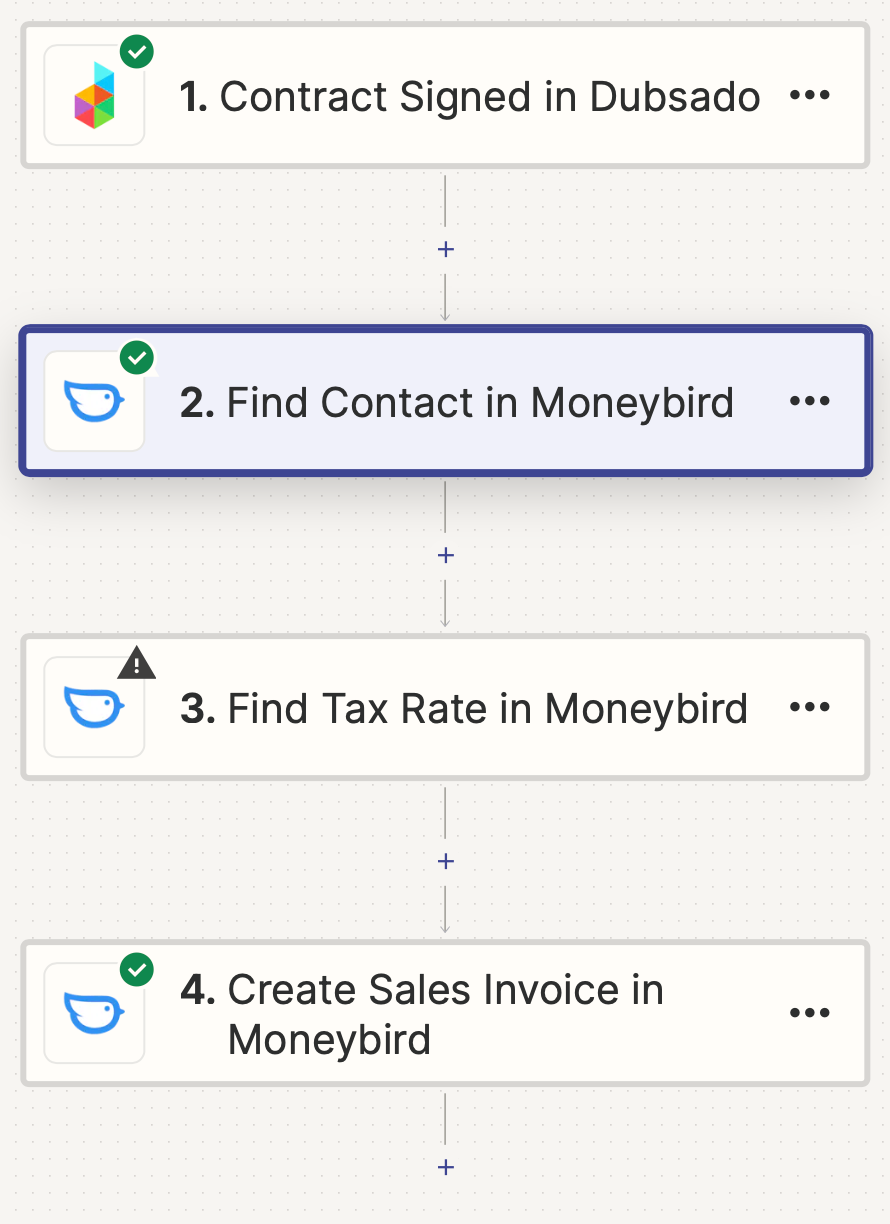

I would like that when a customer has signed her contract in Dubsado, an invoice for this contract is automatically sent in my accounting program (Moneybird). I have now set a number of things, but I think the VAT rate also needs to be looked up first? Or isn’t that necessary?

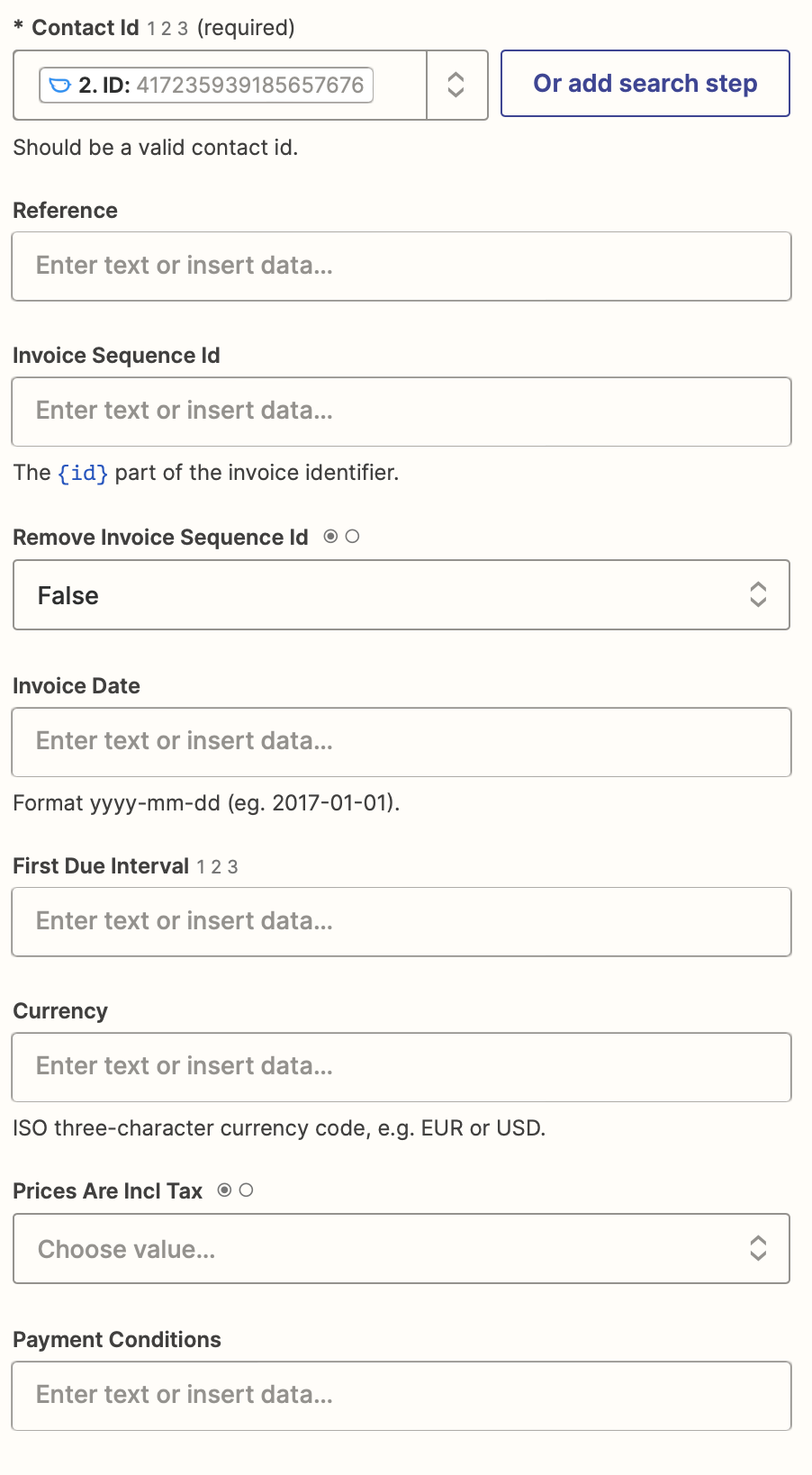

And then I’m getting stuck at the step ‘create sales invoice in Moneybird’. Besides the ID, I don't really know which fields I need to fill in there and where I can find them in the Dubsado contract.

Is there anyone who can help me?